Revolutionizing Mortgage: A Modern Mobile POS Tool

The launch of the mobile POS mortgage pricing tool marked a paradigm shift in the world of mortgage finance. Brokers celebrated the ease with which they could offer clients instantaneous, transparent rates. Clients, on the other hand, felt empowered, enjoying a level of clarity previously unseen in the mortgage process.

Project Details

The launch of the mobile POS mortgage pricing tool marked a paradigm shift in the world of mortgage finance. Brokers celebrated the ease with which they could offer clients instantaneous, transparent rates. Clients, on the other hand, felt empowered, enjoying a level of clarity previously unseen in the mortgage process.Revolutionizing Mortgage: A Modern Mobile POS Tool

In the competitive world of mortgage and finance, businesses are constantly seeking ways to enhance their offerings and streamline operations. The development of a cutting-edge mobile Point of Sale (POS) mortgage pricing tool is a testament to this. This case study unveils the journey behind the tool’s creation and how pivotal elements like digital strategy, user experience design, headless CMS, and Google Firebase played crucial roles in its success.

Background:

Amidst increasing demands for digital solutions in mortgage processes, a leading financial institution identified the opportunity to offer a tool that would revolutionize the way brokers and clients interacted. The aim was to create a mobile POS tool that offered real-time mortgage pricing, providing users with transparency and speed.

Phase 1: Laying the Groundwork – Digital Strategy

The bedrock of any successful digital project lies in a meticulously planned digital strategy. The institution was aware of this and prioritized:

User Identification: Recognizing that brokers and clients would have varying needs.

Competitive Analysis: Surveying the market landscape to find unique value propositions.

Outcome:

A robust strategy ensuring that the POS tool would be user-centric, provide real-time data, and stand out in the marketplace.

Phase 2: The User at the Forefront – User Experience Design

Recognizing that the tool’s success would hinge on its ease of use, the focus shifted to user experience design.

Design Features:

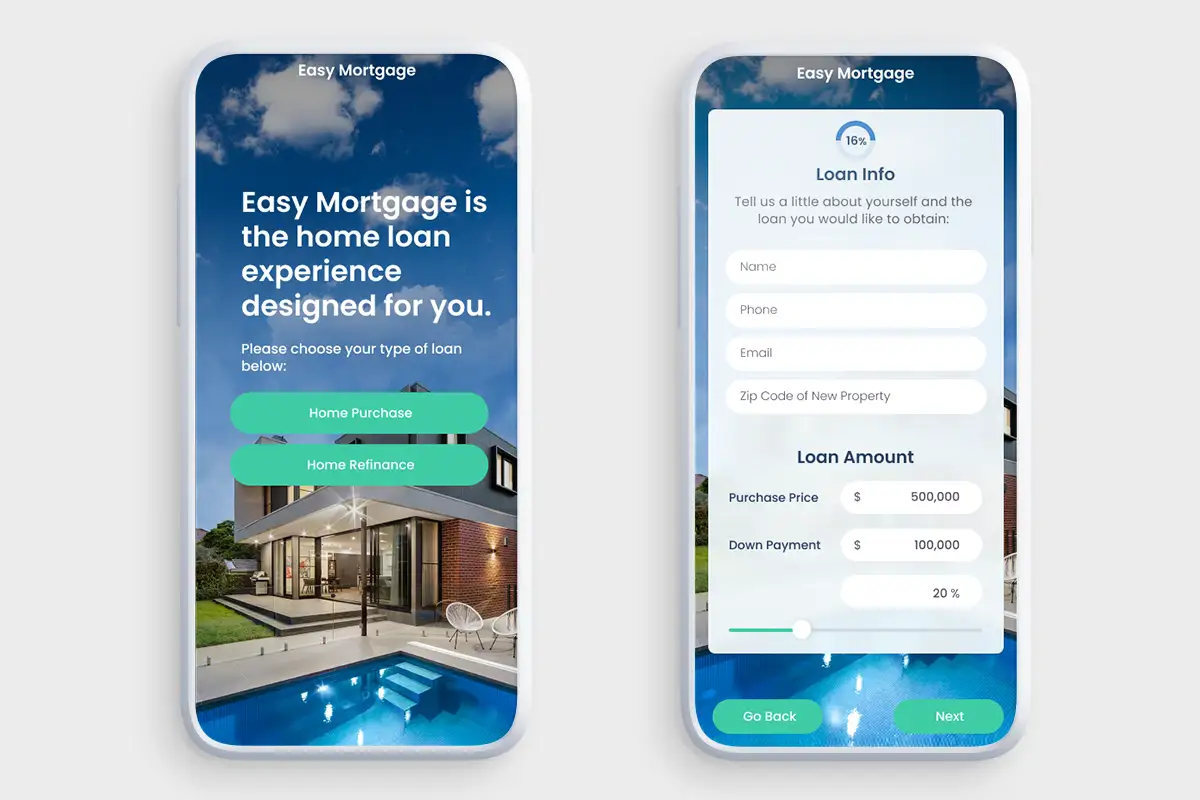

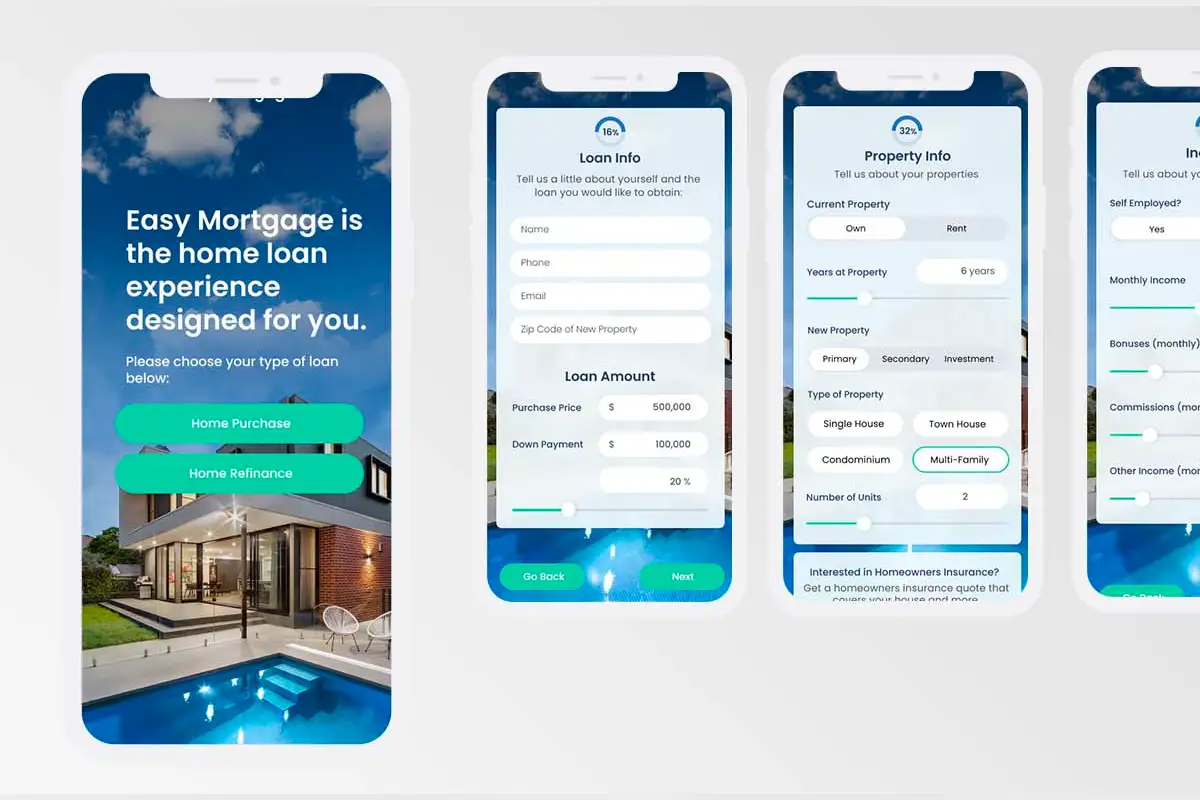

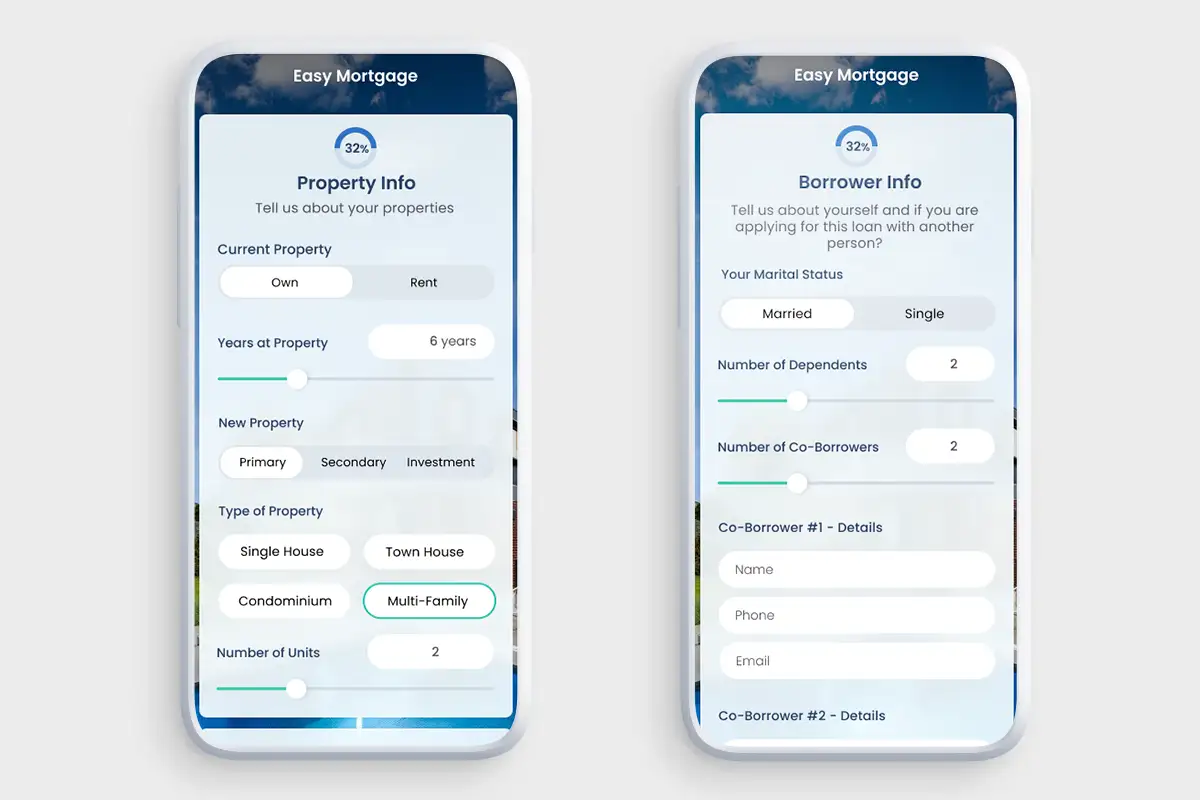

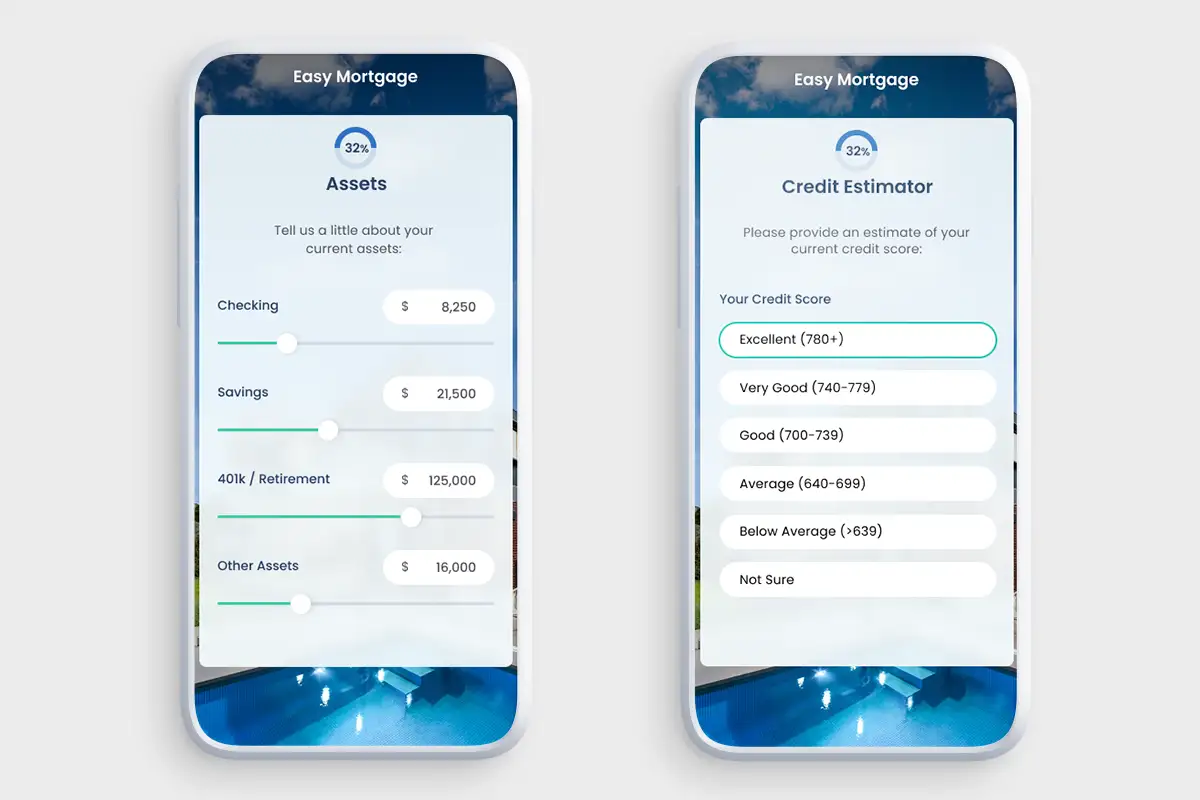

Interactive User Interface: Easy-to-use sliders and calculators for mortgage pricing.

User Profiles: Separate interfaces for brokers and clients to cater to their unique needs.

Feedback System: Users could provide real-time mortgage rates and tool performance feedback.

Outcome:

A tool that, through thoughtful design, became an intuitive companion for users, streamlining the mortgage pricing process.

Phase 3: Seamless Updates – Headless CMS

A dynamic tool like the POS mortgage pricing system demanded regular updates. Implementing a headless CMS ensured that the back-end content management could operate independently of the front-end display.

Benefits:

Agility: The institution could swiftly update mortgage rates and related content without disrupting user experience.

Scalability: As the tool gained more users, the headless CMS ensured the back end could handle the increased demands effortlessly.

Outcome:

A resilient system that could evolve without hiccups, always offering users the most current mortgage data.

Phase 4: Reliable Backend Support – Google Firebase

To bolster the tool’s back end, the institution chose Google Firebase for its myriad of benefits.

Advantages:

• Real-time Database: Crucial for a tool that promised real-time mortgage rates.

• Authentication: Enhanced security, ensuring user data was protected.

• Analytics: Providing insights into user behavior, helping refine the tool further.

Outcome:

With Firebase, the institution had a sturdy, reliable, and insightful back end, ensuring the tool’s smooth operation and continuous improvement.

In the vast realm of financial digital solutions, this modern mobile POS tool is not just another app; it’s a beacon, guiding the mortgage industry towards a future of transparency, efficiency, and unparalleled user satisfaction.